Mission & Vision

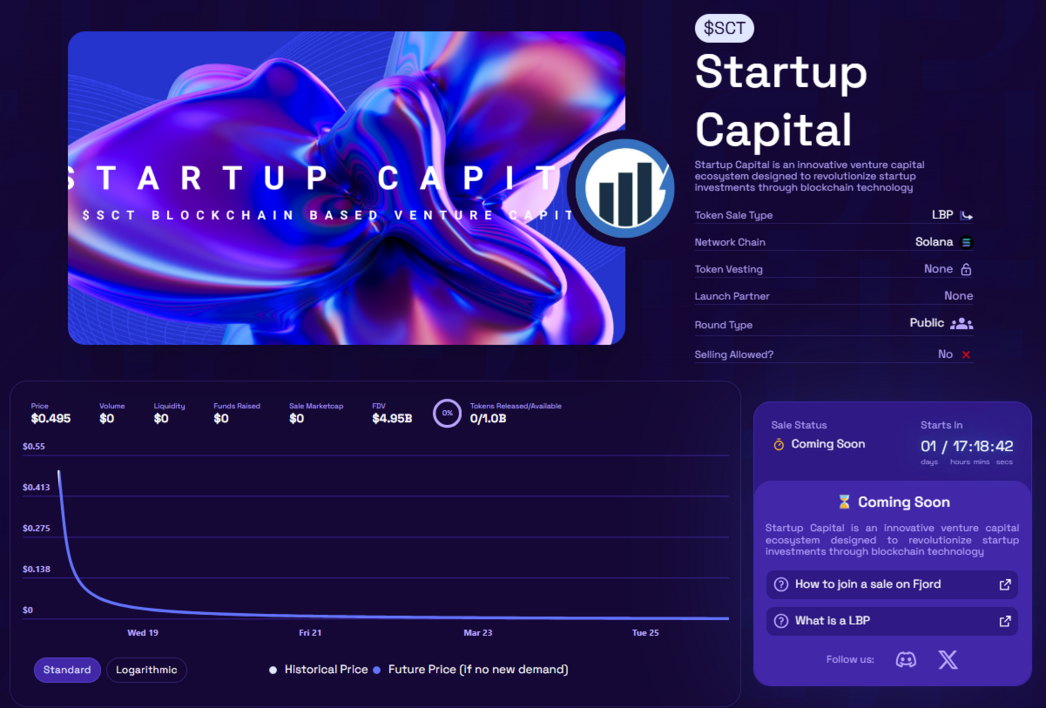

Startup Capital is a decentralized venture capital ecosystem that leverages blockchain technology to fund early-stage startups. Our mission is to empower everyday investors to participate in high-potential investments, traditionally reserved for large venture capital firms and wealthy individuals.

Our Vision

At Startup Capital, we believe that innovation should be accessible to all. By tapping into the power of decentralized finance (DeFi) and blockchain, we aim to build a transparent, community-driven platform for funding the next generation of startups.

Our Mission

Our mission is to democratize venture capital. We provide the tools and ecosystem for everyday investors to discover and back promising entrepreneurs. In doing so, we fuel global innovation, while enabling our community to benefit from startup success.